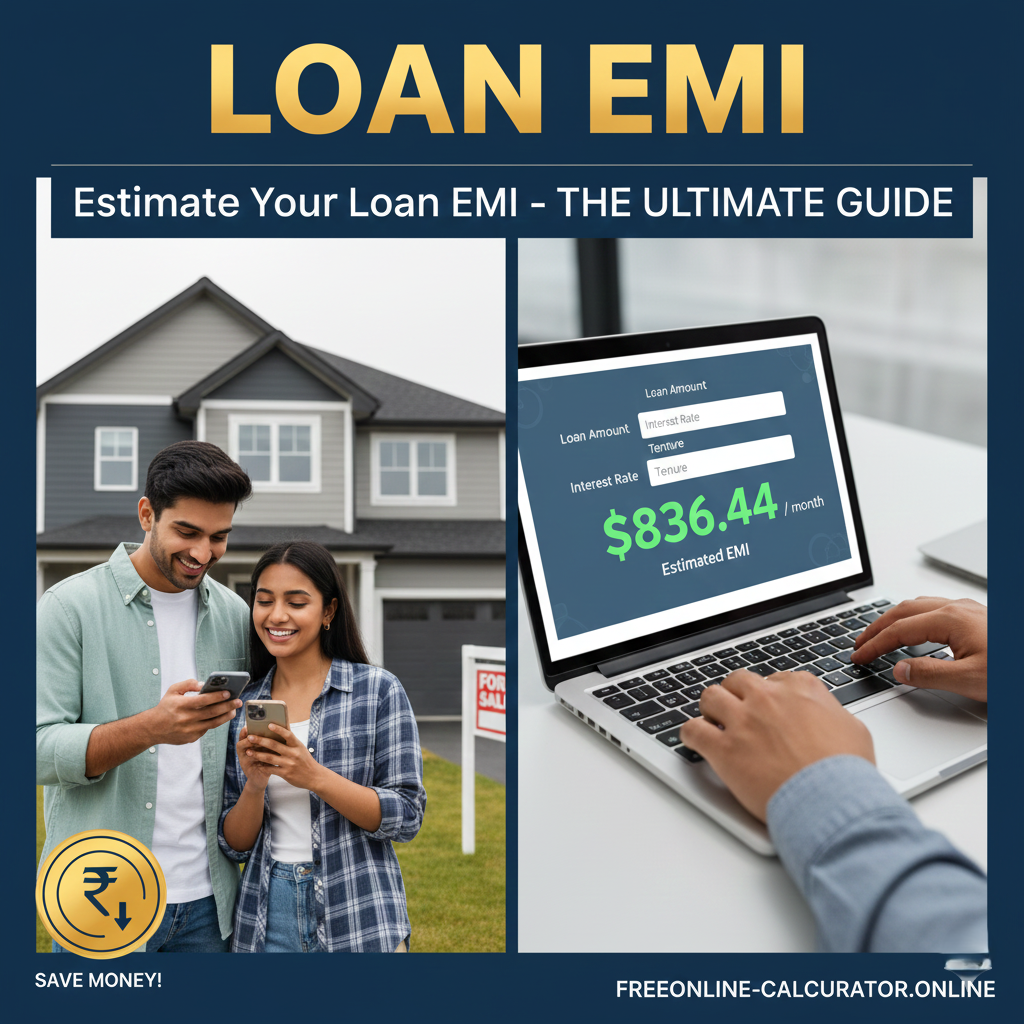

How to Accurately Estimate Your Loan EMI Before Applying (A Deep Dive)

Before you sign any bank document, the most critical step you must take is to Estimate Your Loan EMI. Taking a loan is a long-term commitment, and understanding the monthly financial burden is essential for maintaining your peace of mind. In today’s volatile economy, where interest rates fluctuate frequently, relying on a manual guess can lead to severe financial distress.

According to reports by The World Bank, financial literacy—specifically understanding debt obligations—is the leading factor in household wealth stability. In this deep dive, we will explore the mathematics behind EMI, the impact of tenures, and how to use digital tools like our Percentage Calculator to refine your financial planning.

Why You Must Estimate Your Loan EMI Before Commitment

When you Estimate Your Loan EMI, you are not just calculating a number; you are assessing your future lifestyle. Many borrowers make the mistake of looking only at the principal amount. However, the true cost of a loan includes interest, processing fees, and the impact of the “time value of money.”

Using an accurate estimation allows you to:

- Avoid Over-Leveraging: Ensure your EMI does not exceed 40% of your take-home pay.

- Compare Lenders: Different banks offer different rates. A slight change in percentage can save you thousands.

- Plan Your Tenure: Decide whether a short-term or long-term loan fits your cash flow using our Date Calculator to track the repayment timeline.

The Mathematical Formula Behind EMI

To truly master your finances, you should understand how banks calculate your monthly payments. While most people use a digital tool, knowing the manual formula provides deep insight into how interest works. To Estimate Your Loan EMI, banks use the following formula:

Understanding the Variables:

- E: The Equated Monthly Installment (EMI).

- P: Principal Loan Amount (The initial amount you borrow).

- r: Monthly Interest Rate (Annual rate divided by 12 months).

- n: Loan Tenure in months (Years multiplied by 12).

For complex calculations involving powers and exponents in this formula, you can rely on our high-precision Scientific Calculator.

Step-by-Step Example: A Real-World Scenario

Let’s say you want to take a Home Loan. You need to Estimate Your Loan EMI for a principal of $100,000 at an interest rate of 8% for 20 years.

| Component | Value |

|---|---|

| Principal (P) | $100,000 |

| Annual Interest Rate | 8% |

| Monthly Rate (r) | 0.00667 (8% / 12 / 100) |

| Tenure in Months (n) | 240 (20 years * 12) |

| Estimated EMI (E) | $836.44 |

Over the course of 20 years, your total payment will be $200,745. This means you are paying back double what you borrowed! This is why using a Fraction Calculator to understand the ratio of interest vs. principal is a smart move for any borrower.

The Role of Amortization Schedules

An Amortization schedule is a table that shows how much of each payment goes toward the principal and how much goes toward interest. In the beginning, a huge chunk of your EMI goes toward interest. As the years pass, the ratio shifts toward the principal. Organizations like Investopedia explain that understanding this curve can help you decide when to make “Pre-payments” to save on interest costs.

How to Optimize Your Loan for Better Rates

To effectively Estimate Your Loan EMI, you must also look at ways to lower it. Here are three GEO-specific and SEO-driven tips:

- Improve Your Credit Score: A higher credit score can reduce your interest rate by 1-2%. Check your score at Experian.

- Negotiate the Tenure: Longer tenures mean lower EMIs but much higher total interest.

- Use a Random Number Generator: If you are undecided between different loan offers, sometimes simulating different “What-if” scenarios with our Random Number Generator can help you test your budget’s flexibility.

AEO and Geo-Financial Considerations

If you are looking to Estimate Your Loan EMI in 2026, keep in mind that local central bank policies (like the Federal Reserve in the US or the State Bank in Pakistan) dictate the base rates. Always factor in a “buffer” of 1-2% in your budget to account for potential rate hikes in floating-rate loans.

Conclusion

Knowledge is the best hedge against debt. When you Estimate Your Loan EMI accurately, you take the first step toward a debt-free life. Use the tools available at Free Online Calculator to run your numbers, compare different bank offers, and choose a path that ensures your financial well-being.